Exploring the Stability and Returns of Government Bonds

Government bonds, also known as sovereign bonds, represent debt securities issued by national governments to finance public spending and infrastructure projects. Renowned for their stability and reliability, government bonds are considered a cornerstone of conservative investment portfolios, offering investors a predictable stream of income and a safeguard against market volatility. Understanding the mechanics of government bonds, their role in the global economy, and the factors influencing their yields is essential for investors seeking to diversify their portfolios and preserve capital.

Related searches

-

Series Ee Government Bonds Value

-

Government Bond

-

Us Government Bonds

-

Government Bonds Rates

-

Government Bond Rates

-

Capital Group | American Funds - Fixed Income Investments

Government Bonds: The Bedrock of Fixed-Income Investments

Government bonds are characterized by their fixed interest payments, known as coupon payments, and their principal repayment upon maturity. These bonds are typically issued with varying maturities, ranging from short-term Treasury bills to long-term Treasury bonds, providing investors with flexibility in managing their investment horizons and risk profiles. The creditworthiness of government bonds is backed by the full faith and credit of the issuing government, making them one of the safest investment vehicles available in the financial markets.

Assessing Risk and Return: Understanding the Yield Curve

The yield curve, a graphical representation of the relationship between bond yields and their respective maturities, serves as a crucial tool for assessing the risk-return profile of government bonds. In a normal yield curve environment, longer-term bonds typically offer higher yields to compensate investors for the increased risk associated with locking in funds for an extended period. Conversely, an inverted yield curve, where short-term yields exceed long-term yields, may signal economic uncertainty and impending recession, impacting investor sentiment and bond pricing.

Global Impact: The Role of Government Bonds in Financial Markets

Government bonds play a pivotal role in shaping the dynamics of global financial markets, influencing interest rates, currency valuations, and investor sentiment. Central banks often use government bond purchases and sales, known as open market operations, to implement monetary policy objectives, such as controlling inflation, stimulating economic growth, or maintaining financial stability. Moreover, government bond yields serve as benchmarks for pricing other fixed-income securities, providing a reference point for corporate bonds, mortgage-backed securities, and other debt instruments.

Diversification and Preservation: Incorporating Government Bonds into Investment Portfolios

For investors seeking to diversify their portfolios and mitigate risk, government bonds offer an attractive complement to equities and other higher-risk assets. By allocating a portion of their investments to government bonds, investors can enhance portfolio stability, preserve capital during periods of market downturns, and generate steady income through coupon payments. Additionally, government bonds serve as a hedge against inflation, as their fixed interest payments maintain purchasing power over time, providing a reliable source of income in a rising price environment.

Harnessing the Power of Government Bonds for Long-Term Wealth Preservation

Government bonds represent a cornerstone of conservative investment strategies, offering investors stability, reliability, and income generation in an uncertain financial landscape. By understanding the mechanics of government bonds, assessing risk-return dynamics through the yield curve, and incorporating bonds into diversified investment portfolios, investors can harness the power of government bonds to preserve capital, achieve financial goals, and navigate the complexities of modern finance with confidence. Whether seeking income generation, capital preservation, or portfolio diversification, government bonds offer a valuable tool for investors looking to build a solid foundation for long-term wealth preservation and prosperity.

Top Gold Investment Plans for Building Wealth and Security

Investing in gold has long been considered a safe haven for securing wealth, particularly in times of economic uncertainty. If you're looking for ways to diversify your portfolio or protect your assets, here are some of the best gold investment options you can explore today.

The Future of Innovation: How Biotechnology Companies Are Changing the World

Biotechnology is at the forefront of groundbreaking advancements, transforming industries from healthcare to agriculture and beyond. Biotechnology companies are driving innovation with cutting-edge solutions in medicine, environmental sustainability, and food production. If you're interested in the future of science and technology, now is the time to explore the world of biotech.

The Power of Mortgage Loans

In the journey towards homeownership, mortgage loans serve as the key that unlocks the door to your dream home, providing the financial means to turn aspirations into reality. Let's delve into the world of mortgage loans and discover how they empower individuals and families to achieve their homeownership goals with confidence and ease.

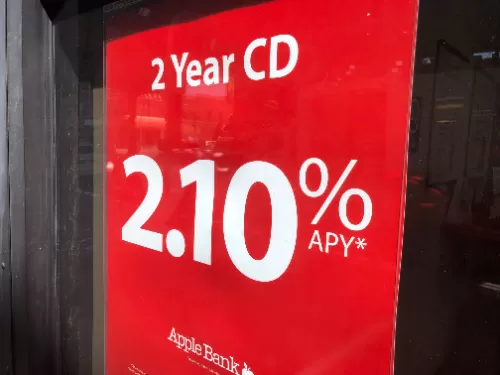

Navigating the Terrain of CD Rates: A Guide to Maximizing Your Savings

In the realm of personal finance, Certificate of Deposit (CD) rates play a pivotal role in helping individuals grow their savings. Whether you're a seasoned investor or a newcomer to the world of financial planning, understanding CD rates is essential for making informed decisions about your money.

Revolutionize Your Borrowing Experience with Cutting-Edge Loan Apps

In the fast-paced world of finance, staying ahead means embracing innovation, and loan apps are at the forefront of this revolution. These dynamic mobile applications offer a seamless and efficient way to access credit, putting the power of borrowing directly into your hands. Let's dive into the realm of loan apps and discover how they can transform your borrowing experience for the better.

Best Tax Filing Services: File Your Taxes Fast & Maximize Your Refund

Tax season is here, and finding the best tax filing service can make all the difference. Whether you’re looking for a quick and easy way to file or need expert assistance to maximize your refund, choosing the right service is essential. Here’s a breakdown of the top-rated tax filing services in 2024 that can help you file with confidence.

By:

ADA

By:

ADA